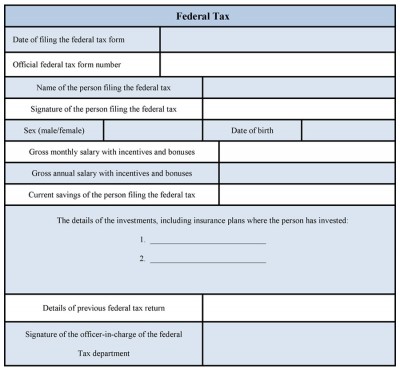

A federal tax form is an important document in order to record the information regarding the income, investment and savings of an individual in an organized manner. The form needs an accurate data in respect of the desired space as this form has an importance to apply for the tax return and it helps to avoid the complication regarding the tax paying too. So, the form has a wide use as per the law of the states.

A sample federal tax form contains information regarding the personal details of the applicant and its allowance amount and filing status. You can check the form in online that contains an estimated amount of income and savings. Below an example is provided for your use.

You can download the template of the form both in PDF and word format and customize the document as per your own needs and then print your form if needed.

Federal Tax Form Sample

Download Easy to Edit Federal Tax Form at only $3.00

Download Easy to Edit Federal Tax Form at only $3.00

Related Posts to Tax Forms

Capital Gain Tax Form

A capital gain tax form is a very important document in order to get the tax benefit of selling a non-inventory asset.

Income Tax Form

An income tax form is needed to record information about an individual’s income and savings in order to calculate the tax liability.

Income Tax Return Form

An income tax return form is needed to fill up the form regarding an individual’s income, saving, business details and the details about the tax refund with the concerned authority.

Property Tax Form

A property tax form is issued to record the detail information about the property in order to pay the property tax.

Sales Tax Form

A sales tax form is the document that records information about the sales tax of a company or an individual.

Self Employment Tax Form

A self employment tax form, as its name says, is made for those who are self employed that means working as a freelancer.

Service Tax Form

A service tax form is an important document as it records the details of an individual as a taxpayer.