Public Works Payroll Reporting Form is a form used by contractors in projects which are at least partially funded with government funds. Such forms are required to track who is working on the project and the details of salary and others deductions made. This form can also be used to file payrolls according to the requirements of the labor code.

The basic details required under this report form are name and social security number of each employee, the classification of each employee, working hours of employees, the gross amount, individual deductions and finally the net amount payable to employees.

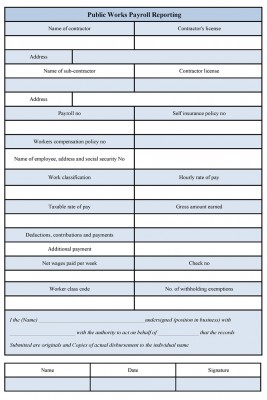

Below is an example of sample public works payroll reporting template.

Public Works Payroll Reporting Form

Download Easy to Edit Public Works Payroll Reporting Form at only $3.00

Download Easy to Edit Public Works Payroll Reporting Form at only $3.00

Related Posts to Payroll Forms

Payroll Direct Deposit Form

In present times, online bank transactions have become the most comfortable way of making payments.

Payroll Tax Form

Payroll taxes have to be paid by employee or employers. In almost every country, employers are required to deduct payroll tax.

Payroll Register Forms

A payroll register form contains important employee payroll information. Such forms allow easy access and understanding of data.

Payroll Ledger Form

Payroll Ledger Form is a form used for recording payment made to employees of an organization.

Payroll Employee Form

A Payroll employee form has to be filled by an employee at the time of employment. Such form contains details of the employee, total salary and the details of various deductions.

Payroll Deduction Form

Payroll deduction form contains details of the amount withheld by an employer from employee’s earnings.

Payroll Deduction Authorization Form

A payroll deduction Authorization form is an agreement form which is used by an employee wherein the employee authorizes deduction of a certain amount of money from his or her salary.

Free Payroll Form

A Payroll Form is used to record employee’s salaries, wages, bonuses, net pay and deductions.